There are thousands of diesel-powered vehicles in the mining industry. Decarbonizing this existing fleet is a key step in addressing industry’s carbon footprint. Alternative diesels may hold the answer.

By Jonathan Rowland

Hydrogen and electrification are often talked about in the context of decarbonizing mobility in mining. But both routes require significant investment in new technologies and infrastructure, as well as time to implement. In the meantime, there remain thousands of diesel-burning mining vehicles, many of which may have years of operating life left in the tank.

Low-carbon alternative diesels, such as renewable diesel and biodiesel, offer an immediate solution to this challenge: not only can these fuels be used in existing heavy-duty diesel engines, they also require limited (or no) infrastructure investment. They thus represent an affordable option, available today, to allow mining companies to start reducing emissions.

Rio Tinto is one mining company to recognize this potential. “Carbon emissions from the use of diesel in Rio Tinto’s mobile fleet and rail account for 13% of our Scope 1 and 2 emissions,” Nigel Steward, chief scientist at the mining major, told North American Mining. “We are targeting battery electrification to eliminate these emissions; however, current battery technology cannot deliver the energy density required for large mining vehicles.”

While Rio Tinto expects battery technology to “develop over time,” it is only likely to be ready for mass deployment between 2030 and 2035. As such, “an interim step to accelerate our progress toward net zero” is required, continued Steward. “We believe renewable diesel can play this role.”

The company has successfully completed a renewable diesel trial in smaller haul trucks at its U.S. Borax mine in Boron, Calif. It is now conducting a second trial at the Kennecott copper operations in Salt Lake City, Utah, to determine the suitability of renewable diesel for open-pit haulage. This trial will compare acceleration, speed, cycle times, fuel usage and engine inspection reports for two trucks running on renewable diesel against two running on conventional diesel. “It is important that we test the technology in different operating environments and on different mining equipment,” said Steward.

Following the California trial, however, Rio Tinto is already planning to transition the whole heavy machinery fleet at its Boron location to renewable diesel by 2024. The switch is anticipated to reduce CO2e emissions by up to 45,000 tonnes per year for this site. “Our renewable diesel trials thus support our decarbonization objectives, which include a 50% reduction in Scope 1 and 2 emissions by 2030, and a commitment to reach net zero by 2050,” added Steward.

SO, WHAT IS ALTERNATIVE DIESEL?

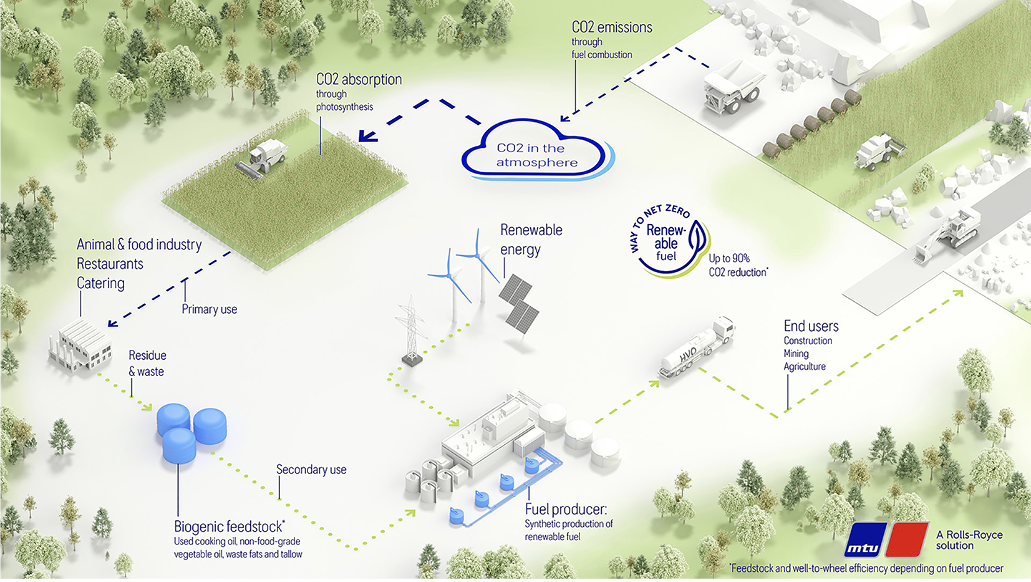

There are several low-carbon alternative diesels available to the mining industry, including the renewable diesel trialed by Rio Tinto (also known as hydrotreated vegetable oil, HVO), biodiesels, and e-diesels. So, what’s the difference?

RENEWABLE DIESEL (HVO)

The benefits of renewable diesel are “clean combustion with a reduction in particulate emissions of up to 80%, nitrogen emissions of 8% and – depending on the manufacturing process and feedstock – CO2 emissions of up to 90%, compared to conventional diesel,” explained Andrew Suda, senior manager – Service Sales, Americas at Rolls-Royce Power Systems, one of the partners with Rio Tinto, which were running mtu engines on the U.S. Borax trials.

“Because it is produced from biomass raw materials, its combustion only generates about as much greenhouse gas emissions as were absorbed by the plants during their growth,” the Rolls-Royce Power Systems expert continued. “And thanks to its production from residual and waste materials, there is no competition with food production. In addition, compared to electrification an hydrogen, HVO requires no new infrastructure and no new propulsion system because it is a drop-in fuel: it can be used without modification of the engine.”

For example, Neste MY Renewable Diesel – which was used during the U.S. Borax trial – is “made from 100% renewable materials, such as used cooking oil, in our refineries in Singapore, Finland, and the Netherlands,” Carrie Song, vice president, Renewable Road Transport, Americas at Neste, told North American Mining. “We accept only sustainably-produced raw materials from carefully selected suppliers, who have committed to sustainability, protecting biodiversity, and respecting human rights.”

The company’s diesel is already widely used in the road transport industry, continued Song. “However, since it is a drop-in solution, it has the potential to help all the hard-to-abate industries reduce greenhouse gas emissions now. The Rio Tinto program is a perfect example. Neste’s renewable diesel is chemically the same as fossil diesel, so it can provide the same reliability, efficiency, and resilience that are required for heavy-duty equipment. In addition, Rio Tinto did not need to invest in a new fleet or build infrastructure to make the switch because Neste MY Renewable Diesel is compatible with all existing diesel engines and fuelling infrastructure.”

Because they burn much more cleanly than traditional diesels, there may also be maintenance benefits to switching to renewable diesel. According to Song, “due to its high cetane number and zero aromatics, our renewable diesel reduces the build-up of deposits in engine filters and injectors, leading to longer maintenance cycles and shorter downtime. It is also very stable and has outstanding storage properties: it does not attract water and has a very small risk of bacterial growth. And it performs well in cold weather.”

“When engines run on alternative fuels, their combustion typically results in less soot contamination of engine oil,” added Alejandro Polanco, mining technical manager at Cummins. “This may result in savings over a machine’s lifetime through fewer oil changes.”

BIODIESEL

Biodiesel is a methyl/ethyl ester-based oxygenate known as fatty acid methyl ester (FAME). Various industrial societies have developed standards for biodiesel (e.g., DIN EN 14214, ASTM D 6751, ASTM D7467, and ASTM D975), which define how to formulate biodiesel and how it is to be blended: it can range from 0% (distillate diesel) to 100% (pure biodiesel).

Chevron Renewable Energy Group produces a range of clean diesels, including both renewable diesel and biodiesel, as well as a proprietary blend of both, UltraClean BlenD. “These fuels are made from a variety of bio-feedstocks including animal fats, inedible corn oil, recycled cooking oil and vegetable oils,” said Todd Ellis, vice president, Sales and Marketing at Chevron. “To produce biodiesel, we use a process called transesterification, which converts the oils or animal fats to FAME.”

Biodiesel production also requires methanol, which is typically made from conventional natural gas (as is the hydrogen used to make renewable diesel). Both can be produced using renewable resources, however, which would allow further offsetting of carbon emissions. For example, at Chevron Renewable Energy Group’s biodiesel plant in Albert Lea, Minn., the company has installed a wind turbine to provide renewable energy to the site and lower its carbon footprint.

“Our biodiesel may reduce fossil carbon emissions by up to 100%, as well as reducing both total hydrocarbon and particulate matter by up to 70%,” continued Ellis. “The carbon intensity score for biodiesel has also been consistently lower than both liquid natural gas (LNG) and hydrogen for years. Versus electric, biodiesel may be 56% more effective at reducing carbon when taking the grid into consideration, based on eGRID 2020 figures for carbon intensity of electric vehicles (EV) and EV EER of 3.9 for transit buses per the National Renewable Energy Laboratory.”

E-DIESEL

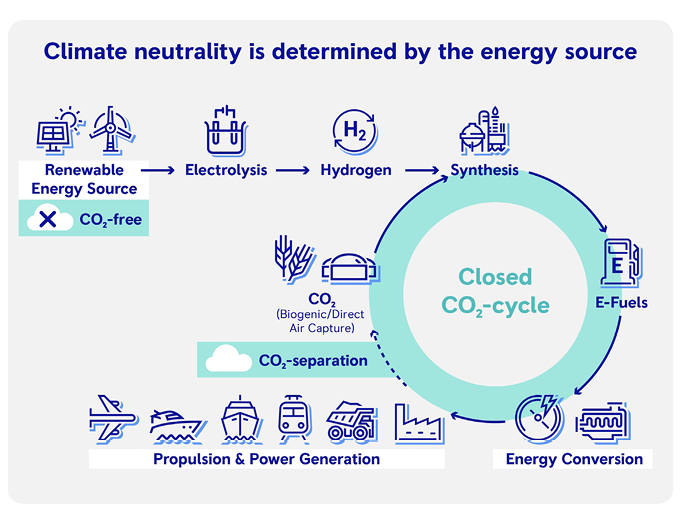

E-diesel is one of a group of fuels known as e-fuels. As noted above, these fuels are entirely synthetic, rather than relying on bio-feedstocks. Rolls-Royce Power Systems’ Andrew Suda detailed their production for North American Mining:

“Electricity produced from renewables is used to break water down into its constituent components – hydrogen and oxygen – via electrolysis,” Suda explained. “The hydrogen can be used in a hydrogen engine or fuel cell; however, hydrogen’s relatively low density means it needs a lot of tank space. It is also anything but easy to store and transport. Alternatively, it can be used to produce other fuels that have higher energy density and are less problematic when it comes to storage. By applying more energy and adding carbon – either airborne or from biomass – it is possible to produce other synthetic fuels, such as e-methane and e-diesel.”

E-diesel itself is mainly produced via the Fischer-Tropsch process, continued the Rolls-Royce Power Systems expert, and has an energy density comparable to traditional diesel. It contains “hardly any sulfur and no aromatics, and has a higher ignition propensity, due to its chemical structure. As a result, it burns more cleanly and is better suited to storage.”

Engines that use e-diesel as fuel are “carbon-neutral in operation because, although CO2 is produced when e-diesel is burned, CO2 is removed from the atmosphere in the synthesis process to produce the fuel,” concluded Suda. These fuels are, however, not yet widely available.

ALTERNATIVE DIESELS AND CARBON EMISSIONS

When comparing fuels, it is important to “consider the well-to-work carbon intensity,” said Cummins’ Leigha Chadwell. Carbon intensity is the amount of carbon emitted per unit of energy consumed, while “well-to-work” refers to the carbon intensity coming both from the production and distribution of the fuel, as well as from burning or consuming the fuel.

“Biodiesel, paraffinic fuels, and e-diesel can all reduce well-to-work carbon intensity by up to 90%, but exact measurements vary based on the feedstock and fuel pathway,” continued Chadwell. “Across these alternative fuels, the reduction comes primarily from the ‘well-to-tank’ pathway – that is, fuel production and distribution. Tank-to-work emissions – those produced during combustion – are more comparable to diesel. To be sure of carbon intensity reductions, miners should go directly to the fuel supplier.”

Whatever the exact carbon emissions reduction, the key attraction of alternative diesels is that they can be used to reduce emissions now: they are “truly drop-in solutions, giving miners the flexibility to operate existing equipment, as normal, with familiar service intervals,” said Robert Schaefer, director, Mining Innovations and Growth Initiatives, at Cummins.

For example, no modifications to hardware or software are needed to run approved Cummins engines and generator sets on HVO fuels or HVO fuel blends, according to Schaefer. Yet “miners can expect to maintain the production and performance they are used to with diesel. Miners also have further flexibility to manage costs and supply through blending paraffinic fuels, such HVO with diesel at any rate, from 0 to 100, for approved engines.”

“Simply put, alternative diesels are an incredibly easy transition for a mining fleet that can also make a substantial carbon impact,” concluded Chevron’s Todd Ellis.

CHALLENGES OF ALTERNATIVE DIESELS: COST, AVAILABILITY

In states with clean fuel programs, such as California and Oregon, the price of renewable diesel is “competitive with traditional diesel,” said Neste’s Carrie Song. In other areas, however, cost and availability remain challenges.

Fuel producers are, however, working hard on expanding supply. For example, Neste is investing in expanding its Rotterdam and Singapore facilities. It has also signed a joint venture with Marathon to produce HVO following the conversion of the former’s Martinez refinery in California.

Biodiesel is “less costly to produce, making it generally more available globally,” added Cummins’ Alejandro Polanco, who also noted that “HVO tends to more readily available in regions where regulations increase demand, such as in California, or throughout Europe.” And while production and supply are ramping up, “demand is also high across many commercial segments; mining will therefore have to compete with other industries to secure supplies.”

In this context, dual fuel solutions may present a “compelling solution” said Polanco’s colleague at Cummins, Gary Johanson. “These solutions – in the form of retrofit solutions – may enable a lifecycle reduction in GHGs from purchased assets, while minimizing the business continuity risk of a full switch to another fuel that may have a supply chain that is still maturing.”

There is also an issue when it comes to consumer understanding. “In the past several years, we have seen an increase in awareness, especially in the road transport industry,” said Song. However, in other sectors, such as mining, alternative diesels are “not very well-known”.

One of the aim of partnerships, such as that between Neste and Rio Tinto, is thus to provide successful case studies for other industry players in the hope that more will move to adopt these fuels.

ALTERNATIVE DIESEL IN THE FUTURE OF MINING

Alternative diesels “will play a crucial role in helping the mining industry reduce its carbon footprint,” continued Song, voicing the general consensus of those we spoke to. “The reality is that there is no silver bullet to solve the climate change crisis. Electric vehicle and other technologies are good solutions for the light duty on-road sector, but liquid fuel and internal combustion engines will continue to play a role in the heavy-duty sectors – at least for the foreseeable future.”

Renewable diesel and biodiesel,

allow the continuing use of these engines, “with no extra capital investment, while also helping to ensure a more sustainable future of the industry, which is what businesses, customers, and the general public want, concluded Song.