Demand For Batteries From E-Mobility And Energy Storage Solutions Is Going To Explode In Coming Years. But Can Lithium Production Keep Up – And Do So In A Way That Is Sustainable, Ethical And Secure?

By Jonathan Rowland

Of all the elements that support 21st century life, you would be hard pressed to find one so misunderstood, yet so vital to our collective future, as lithium. Indeed, until recently, it barely warranted a footnote in reports on the mining industry. Times have changed, however, and today lithium is central to efforts to decarbonize huge swathes of the global economy through its vital role in the manufacture of batteries. It is batteries, after all, that are powering the e-mobility revolution that is underway around the world. Meanwhile, stationary battery storage plays a vital enabling role in the transition to renewable energy generation.

Demand for lithium is therefore going in only one direction. On the supply side however, “bringing on new capacity, both at the resource level and the lithium chemical level, is more challenging,” industry analysts at Roskill stated in a September 2021 note.1 This will likely cause “a shortage of lithium chemicals, which will result in new challenges for the lithium industry.”

The Biden administration has acknowledged the problem, declaring it “imperative [to] invest immediately in scaling up a secure and diversified supply chain for high-capacity batteries here at home. That means […] investing to scale the full lithium battery chain, including the sourcing and processing of the critical minerals used in battery production.”

But recognizing the sustainability conundrum this poses, the administration also committed to creating 21st century standards for the extraction and processing of critical minerals, stating the government should work with the private sector and non-governmental stakeholders to “encourage the development and adoption of comprehensive sustainability standards for essential minerals, such as lithium.” It is to the sustainability of lithium supply that we now turn.

Lithium Production: A Sustainability Headache

There are two major current sources of lithium: hard-rock mining of lithium-containing ores, most often pegmatites containing spodumene, and brines. Both present challenges when it comes to sustainability.

To extract lithium from spodumene, the run-of-mine ore (about 20% spodumene) is crushed and processed, most often via dense media separation (sometimes with subsequent flotation), before being roasted at about 1,050°C. After cooling, it is mixed with sulfuric acid and roasted again, at about 200°C, to produce a concentrate (about 75% to 85% spodumene). Subsequent hydrometallurgical processing turns this concentrate into lithium carbonate or lithium hydroxide, the lithium chemicals most commonly supplied to battery manufacturers.2

Aside from the sustainability issues common to all mining operations, the processing of spodumene, with its high temperature roasting, is highly energy intensive. It is also true that much of the world’s spodumene concentrate is transported from mining sites in Australia to China for processing into battery-ready forms, before being shipped to battery makers around the world. This only adds to the lifecycle environmental costs, which have been estimated at 15,000 kg of CO2 and 170 m3 of water per tonne of lithium hydroxide.3

A further challenge of this process is the removal, generally during concentration, of lithium-containing fines, which are pumped straight to tailings. As a result, about 25% of the lithium content of the run-on-mine ore is lost; it can be up to 50%.

Lithium extraction from brines is also problematic. The vast majority of lithium brine production is located in South America, in the so-called lithium triangle that spans areas of Bolivia, Argentina and Chile. During the process, brine is pumped into giant ponds and concentrated via passive solar evaporation over the course of a year of more. When the lithium concentration has reached a high enough level, the brine is transferred to a processing plant where it is purified and converted into lithium carbonate or lithium hydroxide, before being filtered, dried and bagged.4

The production of lithium in this way therefore requires large quantities of land and water: according to one estimate, per tonne of lithium hydroxide, the process consumes 469 m3 of water.5 This is a challenge because, as Roskill has noted, 70% of lithium extracted from salars comes from areas at high water risk.6 The process also only recovers about 50% of the original lithium content of the brine.7

Questions then hang over the lithium industry. But answers may be on their way. Two pathways are showing particular promise: technologies that remove the need for roasting lithium ore and rely instead on hydrometallurgical processes; and direct lithium extraction (DLE) from geothermal brines.

Roasting Not Required

One of the leaders in the charge to develop a new paradigm for sustainable lithium production is the CEO of Lithium Australia, Adrian Griffin. “We had a look at the lithium industry and came to the conclusion that it operated on a suite of legacy technologies that weren’t appropriate to the battery industry,” he told North American Mining. So, the company went back to the drawing board: “we started with a clean sheet of paper and developed a complete suite of new technologies, starting with improving the extraction of lithium from lithium ores.”

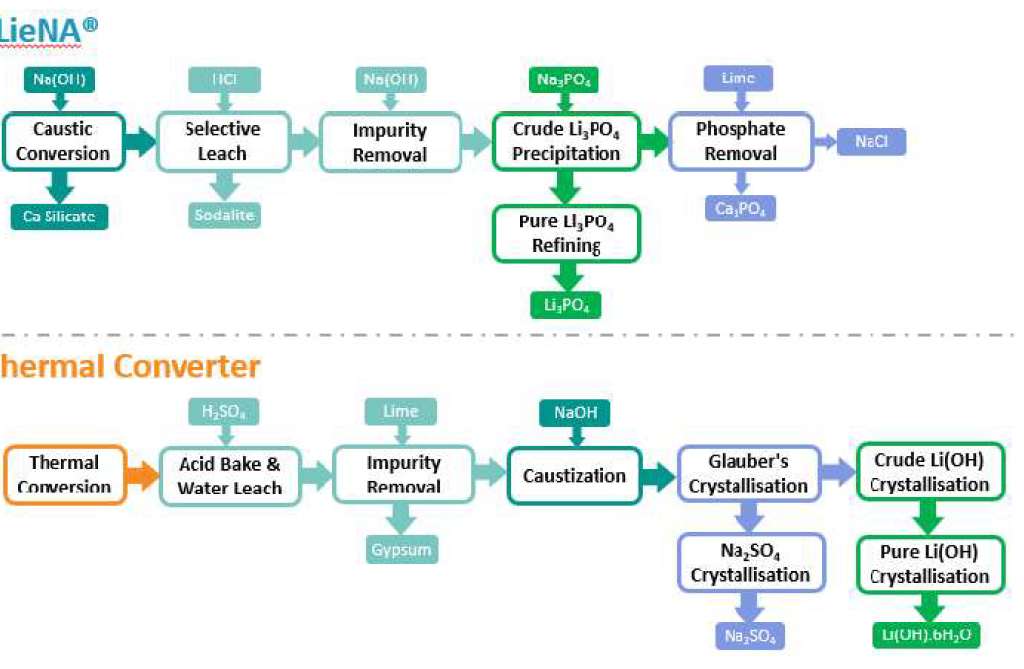

One of the centerpieces of the company’s approach is the LieNA technology, a hydrometallurgical process “similar to the process of converting bauxite to alumina” (Figure 1). During the process, spodumene is fed into an autoclave, where it reacts with caustic soda to form a synthetic lithium sodalite, which is recovered via a simple solid/liquid separation step. The lithium in the sodalite is weakly bound and can be recovered via an ion exchange reaction that substitutes H+ for Li+ by leaching in a weak acid.8

The process brings a number of benefits, explained Griffin. “Firstly, you remove the roasting step and the emissions associated with heating a kiln to over 1,000°C using fossil fuels. In addition, instead of producing lithium hydroxide or lithium carbonate, we can manufacture a range of lithium chemicals. Our preferred chemical is lithium phosphate, as this can be fed directly into the production process of lithium-ferro-phosphate (LFP) powders. In doing so, we remove the intermediary process step that is usually required to turn lithium hydroxide or lithium carbonate into a usable chemical for LFP battery making. That’s particularly important because LFP is the fastest growing sector of the lithium-ion battery market.”

Unlike traditional spodumene processing techniques, which are unable to handle fines, the LieNA process actually requires fine spodumene as a feed source to achieve acceptable kinetics. It can also process contaminated and complex ores. This not only increases the proportion of saleable material produced per unit of mined ore, but it also turns current tailings dams – which contain large amounts of spodumene fines – into potentially economic resources.

“I think the penny’s just starting to drop with the major chemical and spodumene concentrate producers, because they’re realizing you can’t afford to keep throwing valuable resources away when faced with a market that is growing at a phenomenal rate,” the Lithium Australia CEO said.

The company’s LFP powder is currently in testing at battery makers around the world with “an enormous amount of interest,” continued Griffin. “China produces about 98% of LFP cathode powders at the moment with almost all of it supplied to local battery suppliers – and the supply chain is only going to get increasingly restricted. You’ll soon reach a point where there’ll be none available to western producers. Companies are starting to realize this and take steps to secure their supply chains and operate out of the grip of China, which is what our technology offers.”

The moral of the story, according to Griffin, “is to stop fine and contaminated material from going to tailings via a tailored downstream process that produces battery-ready materials. In doing so, you increase the yield and reduce the processing steps: it fits sustainability hand in glove with viability to solve a real problem.”

Lithium Australia is currently constructing a pilot plant, with commissioning expected in early 2022. The plant’s operation will include a couple of pilot runs designed to take low-grade material of the sort that could be recovered from tailings.

A Global Push

Lithium Australia is not the only company seeking innovative ways to open up lithium production. In Cornwall in the south of England, Cornish Lithium is exploring the potential to extract lithium chemicals from lithium micas (lepidolite and zinnwaldite) using the Lepidico L-MAX process. This involves a concentrated sulphuric acid leach of a lithium mica slurry at atmospheric pressure and moderate temperatures, followed by a series of steps to remove impurities at progressively higher pH levels, with the subsequent precipitation of lithium carbonate.9

“Lithium was mined in Cornwall during the second world war,” Jeremy Wrathall, CEO of Cornish Lithium, told NAM. “We’re not doing anything new, but we are re-evaluating what was already known and making real progress. We also have the benefit of existing infrastructure and a huge amount of geological data from Cornwall’s china clay industry. For example, our processing site, which we’ll be taking control of in 2022, already has onsite access to rail and utilities.”

Meanwhile, in Nevada, American Lithium is exploring lithium extraction from claystones using various leach techniques, including a sulfuric acid leach at 90°C, a salt roasting process followed by water leaching, and leaching with hydrochloric acid at 90°C, achieving extraction rates of ٩٧.٤٪, ٨٩.٤٪ and ٩٥.٢٪, respectively.10,11

A final project to note is Rio Tinto’s proposed $2.4 billion Jadar underground mine. The project is targeting a unique lithium-borate ore known as jadarite (LiNaSiB3O7(OH)), with an identified ore reserve of 16.6 million tonnes at 1.81% Li2O and 13.4% B2O3. According to the company, the project has the potential to produce 55,000 tonnes of battery-grade lithium carbonate per year, as well as 160,000 tonnes of boric acid and 255,000 tonnes of sodium sulfate per year.12 The company has also stated its development of a “new, innovative technology for the production of lithium carbonate and boric acid from the mined jadarite ore”, involving a moderate-temperature (<100°C) sulfuric acid leach.13

“The mineralization at Jadar is more akin to evaporitic boron deposits, hosted within soft lacustrine sequences containing mudstones, marls and carbonate-rich sediments,” Roskill said in a December 2020 note.14 “This soft nature will be favorable for processing and beneficiation, which Rio Tinto has spent a decade testing and states can be done economically with high recoveries.”

Direct Lithium Extraction From Geothermal Brines

In contrast to traditional methods of brine processing, direct lithium extraction (DLE) techniques can selectively remove lithium from brines at much lower concentrations, often by use of selective membranes or ion absorption. It is another avenue that Cornish Lithium is exploring.

“Lithium was first recognized in Cornish brines back in 1864,” Cornish Lithium CEO Jeremy Wrathall said. To date the company has drilled and extracted brines from two exploratory boreholes to depths of about 1,000 m. In addition, it has access to brines from the neighboring United Downs deep geothermal power project, under its GeoCubed joint venture with the power plant owner, Geothermal Engineering. Two deep boreholes on that project were drilled in 2019 – including the deepest ever drilled in the UK at 5.2 km.

Cornish brine compares favorably to similar resources, notably those found in the Salton Sea in California, which – despite a very high lithium content (up to 400 mg/kg) – is a “hugely challenging brine”, according to Wrathall. “It’s extremely hot at around 300°C, has very high salinity and contains high quantities of other minerals, such as manganese and zinc.”

“We’re nothing like the Salton Sea,” continued Wrathall. “The salinity is less than seawater, it’s pH neutral, and it contains almost no manganese. We don’t therefore have to store it under pressure or do any pre-treatment. As a result, we believe our CAPEX falls to very low levels.” Meanwhile, lithium concentrations, although lower than the Californian brine at 250 to 260 mg/kg in the deep Cornish brines, compare well to others that have been studied, e.g., in the Upper Rhine Valley, Germany (210 mg/L), and Alsace in France (162 mg/L).15

The company recently selected GeoLith’s Li-Capt DLE technology for its GeoCubed pilot plant, which is due to be commissioned at the end of March 2022, as DLE – long the Cinderella of the lithium industry – moves into the spotlight. “When I started Cornish Lithium, there were two DLE technologies and everyone thought I was crazy,” admitted Wrathall. “Now there’s barely a week that goes by without a new company starting up with its own DLE solution; we’ve evaluated over 25 different technologies. And we now know that China has been using it for a long time.”

The company has already successfully produced lithium carbonate from its brine, as well as battery-grade lithium hydroxide from its hard rock project. “We’re moving quite quickly. There’s a lot of work still to do but we have strong support from the British and local governments. And it really helps to have a geothermal power project next door, as it gives us the opportunity to evaluate both shallow and deep brines,” said Wrathall.

The geothermal power project also adds an extra sustainability dimension as a source of clean power. It’s a combination that’s being explored elsewhere, notably by Vulcan Energy’s Zero Carbon Lithium project in the Upper Rhine Valley and in various projects in the Salton Sea, despite its reputation as the “graveyard for lithium extraction technologies”.16 DLE is also being trialed with non-geothermal lithium brines, including those South American brines mentioned earlier, brines from the Clayton Valley, Nev. (home to the only operating lithium mine in the U.S.), and petroleum brines brought the surface during oil and gas production in Alberta.

For Cornish Lithium, the shallower boreholes have also opened some surprising doors. Although brines from these wells may not have the heat to drive a turbine, at between 50°C and ٩٠°C they are hot enough to provide geothermal heat for most industrial uses. “We have interest from breweries, dairies – even commercial greenhouses – interested in us drilling a borehole next to their facility to provide carbon-free heat for them and brine for us. Our business plan is evolving before our eyes.”

Conclusion

There is little doubt that the world is going to need as much lithium as possible, in a relatively short timeframe, extracted in ways that align with sustainable development goals. That is doubtless a challenge. But as the examples of Lithium Australia and Cornish Lithium show, there are companies rising to that challenge with innovative and – crucially – much more efficient and greener ways of delivering lithium.

Beyond simply extracting more lithium, technologies that extend battery life and performance will also play an important role, as will closing the lithium loop by recycling what will become an ever-growing pile of waste batteries – with Lithium Australia playing a leading role in technology development here too. Indeed, as with most issues of sustainability, there is no single silver bullet: the solution will be found in the combination of specific responses to specific problems. But with so much innovation now underway in the lithium industry, there might just be cause for optimism.

The View of a Mining Equipment Supplier

Of mainstream mining technology suppliers, FLSmidth is among the most progressive in its sustainability agenda. The company is also a leading supplier of equipment for both hard rock and brine-based lithium production. Currently in the world, is an expansion of the Sales de Jujuy Orlaroz lithium facility in Argentina. North American Mining asked Mark Mulligan, vice president – Process Line Management, FLSmidth Minerals Division, about the project, sustainability and what the future holds for lithium production.

NAM: One of the major challenges of lithium extraction from brines is water use – particularly in a region that is water stressed. In the announcement of the Oloraz order, it is stated that one of the aims of the project is to significantly lower water consumption. How is FLSmidth supporting that goal?

Mark Milligan (MM): The combination of selecting the optimal technology through the flowsheet and best practice engineering helps to minimize water consumption. As an example, optimized impurity removal reactors with targeted chemical reactions in different reactors, together with best practice seeding technology, reduces reagent consumption, and hence water consumption. We also optimize polishing filtration by using recycle streams for backwashing rather than fresh water and use best filtration technology for product filtration that requires reduced wash water flowrates than other technologies.

NAM: Lithium brines are a challenging dynamic resource with a composition that changes over time. How does FLSmidth design systems that take account of these conditions and ensure maximum yield?

MM: We closely collaborate with the client to help understand the brine resource better. The dynamic brine conditions are analyzed over multiple seasons to better understand flowrates and concentrations of soluble metals. Meanwhile, our test facilities allow us to test feed variability, and design a system to be flexible in terms of dealing with the fluctuations.

NAM: With lithium demand growing quickly, there is a need to bring assets online as soon as possible. How is FLSmidth supporting the industry to scale up production quickly to meet demand?

MM: We are working with multiple clients around the world to develop their lithium projects, for hard rock and traditional brines, as well as for other alternative lithium sources. Support this work, our world-class testing facilities enable bench and pilot testing that is directly used for flowsheet and equipment design. We are also able to use our experience and extensive test database to optimize and shorten project development cycles, allowing shorter engineering durations. Meanwhile, being a multinational supplier allows us to use our global supply chain to best source for each project.

NAM: How do you see the technology for brine extraction developing in future?

MM: There are many newer lithium deposits being developed where new flowsheets and technologies are being developed. We are working with various clients, including some involving geothermal brines, sedimentary deposits, clay-based deposits, and oilfield brines. It will be exciting to see these newer deposits develop into commercial-scale facilities.

References

1. ‘Roskill: the positive market outlook for lithium results in challenges’, Roskill (1 September 2021): https://uk.sports.yahoo.com/news/roskill-positive-market-outlook-lithium-112700145.html

2. Hard Rock Lithium Processing, SGS Minerals Services (2013): https://www.sgs.com/~/media/Global/Documents/Flyers%20and%20Leaflets/SGS-MIN-WA109-Hard-Rock-Lithium-Processing-EN-11.pdf

3. Zero Carbon Lithium: https://v-er.eu/zero-carbon-lithium/

4. Warren, I., ‘Techno-economic analysis of lithium extraction from geothermal brines’, National Renewable Energy Laboratory (May 2021), pp. 2-3: https://www.nrel.gov/docs/fy21osti/799178.pdf

5. Zero Carbon Lithium.

6. Well, D., ‘Lithium: concerns over water consumption exposes brine producers to ESG risks’, Roskill (1 September 2021): https://roskill.com/news/lithium-concerns-over-water-consumption-exposes-brine-producers-to-esg-risk/

7. Warren, p. 3.

8. About LieNA®’, Lithium Australia: https://lithium-au.com/about-liena/

9. ‘L-MAX®’, Lepidico: https://www.lepidico.com/l-max-technology/l-max

10. ‘American Lithium Reports Highest Lithium Extraction to Date from TLC Claystones with 97.4% Extraction from Sulfuric Acid Leach’, American Lithium (25 August 2021): https://americanlithiumcorp.com/2021/08/25/american-lithium-reports-highest-lithium-extraction-to-date-from-tlc-claystones-with-97-4-extraction-from-sulfuric-acid-leach/

11. ‘Improved Salt Roast – Water Leaching Yields 89.4% Lithium Extraction’, American Lithium (15 September 2021): https://americanlithiumcorp.com/2021/09/15/improved-salt-roast-water-leaching-yields-89-4-lithium-extraction

12. ‘Rio Tinto declares maiden Ore Reserve at Jadar, Rio Tinto (27 July 2021): https://www.riotinto.com/news/releases/2021/Rio-Tinto-commits-funding-for-Jadar-lithium-project

13. Jadar Project: Facts at a Glance, Rio Tinto, (July 2021).

14. ‘Lithium: Jadar measures up’, Roskill (18 December 2020): https://roskill.com/news/lithium-jadar-measures-up/

15. Warren, p. 5. 16. Roth, S., ‘Lithium start-up backed by Bill Gates seeks a breakthrough at the Salton Sea’, Los Angeles Times (16 March 2020): https://www.latimes.com/environment/story/2020-03-16/lithium-startup-lilac-solutions-bill-gates-salton-sea