Mines have traditionally relied on national energy grids, often fossil fuel-based, to provide their electrical energy needs. Where mines are remote or a grid connection is otherwise not feasible, diesel generators fill the gap. But as mining companies grapple with net-zero commitments, low-carbon onsite power solutions offer a key pathway to reducing greenhouse gas emissions.

By Jonathan Rowland

Several compelling reasons exist for mines to consider alternative mine site energy solutions. At the headline level, the net-zero commitments made by many mining companies – including all of the major ones belonging to the International Council on Mining and Metals (ICMM) – require a shift to clean energy sooner rather than later. Those that do not take timely action “risk being accused of greenwashing,” Debra Johnson, senior strategist – ESG and Net Zero Mining, Metal and Minerals at Stantec, told North American Mining.

There are also operational, financial and commercial benefits to being an early mover in the adoption of low-carbon energy solutions, particularly renewables. As Johnson continued, “although building your own energy supply comes with a capital cost, that cost can be offset, not only by reduced operational energy spend, but also by incentives that many jurisdictions are currently offering. Those incentives won’t last forever. Therefore, taking advantage of them now, before they run out, makes sense.”

At the same time, manufacturers are seeking to green their supply chains (or reduce their Scope 3 emissions in the language of the UN Greenhouse Gas Protocol). “Miners that are acting rapidly to achieve their net-zero commitments have been rewarded recently with contracts for their metals by automakers, such as GM, Ford and Tesla,” noted Johnson. “While commodities do not yet carry a ‘green premium’ or ‘brown penalty’, those days are not far off.”

Driving this is a growing awareness of carbon reporting by both investors and consumers – an awareness fueled by accelerating mandatory carbon reporting requirements. “Every buyer of commodities is scrambling to reduce their carbon footprints,” explained Johnson. “The pressure on every level in the supply chain is intense. There is nowhere to hide from these trends.”

“Renewables allow mining companies to assume pole position in the market – and sell their products as green,” agreed Dr. Thomas Hillig, managing director of THEnergy and an expert in the use of renewable energy in the mining industry. “This aspect will become more and more important as many large companies decarbonize their supply chains, back to the very beginning – so, to mining.”

At the same time, cleaner energy solutions are becoming more affordable, noted Steve Stafford, North America sales leader – Mining at Aggreko; they are also more advanced, and thus more portable. This makes such systems much more interesting to mining companies, particularly those can’t rely on a grid connection, as replacements for traditional diesel generators.

“Renewables have been lowering in price for decades,” continued Stafford. “But recent developments have made them even more attractive. The rising cost of fuel has not spared the diesel used for generators, while legislation, such as the Inflation Reduction Act in the U.S., will ultimately lower the cost of distributed energy used in mining projects, such as energy storage. Advancements in energy storage have also made it more reliable and able to store energy for longer periods, which bodes well for its use at mining sites.”

These trends were neatly summarized by Hillig, who explained that the risk profile associated with renewables is rebalancing in favor of their adoption. “The perceived risk of integrating renewables into mining projects is decreasing. Many successful project examples have shown that it can be done. At the same time, costs are coming down, as there is more competition on the supplier side, and finally there is pressure from customer and investors.”

Meanwhile, when mines are in terrain inconducive to renewable microgrids, compressed or liquified natural gas (CNG/LNG) offers a pathway to lower carbon emissions.

“Cleaner fossil fuels can be a much more efficient proposition than diesel generators,” explained Stafford. “Companies like Aggreko have developed virtual pipeline solutions for delivering natural gas to mine sites where renewables can’t yet meet energy needs. Such a power delivery system can dramatically reduce carbon emissions, since CNG generators produce less pollution than diesel generators, as well as saving money.”

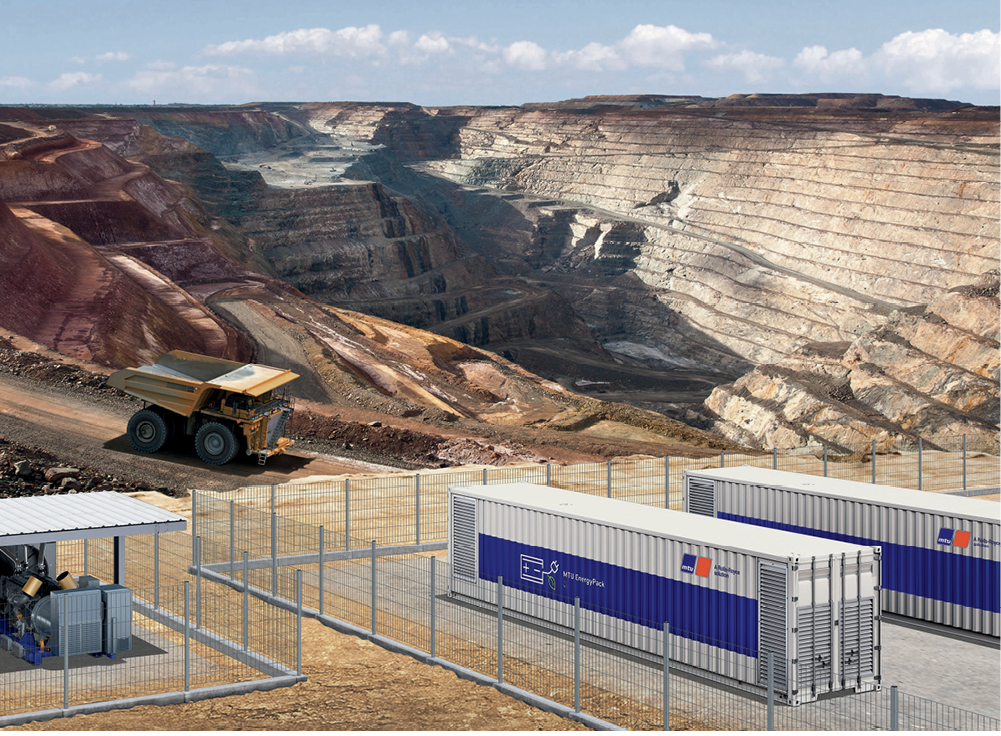

Other more sustainable diesel alternatives include biomass to liquids, hydrotreated vegetable oil (HVO) and power to liquids, such as e-diesel. For example, HVO – which converts waste vegetable and animal fats and used cooking oils into hydrocarbons by means of a catalytic reaction with hydrogen – significantly reduce CO2 emissions by up to 90% compared to fossil diesel, according to Rolls Royce. Particulate matter emissions are also reduced, by 80%, as are nitrogen oxide emissions, by an average of 8%. The company’s power systems business unit recently released most of its mtu engine series for various applications, including mining and power generation, for use with synthetic diesels such as HVO.

Meanwhile, Rio Tinto announced in January 2023 that it had trialed the use of HVO in its mining trucks with mtu engines at U.S. Borax, part of Rio Tinto, in California, and had started a second trial of renewable diesel in collaboration with Cummins at its Kennecott Bingham Canyon copper mine in Utah.

Which renewable energy source?

Of course, renewable energy is a catch-all term for a range of very different technologies. There are also several technologies that, while not technically renewable, are often slotted into the same low-carbon bracket – think biomass or, more recently, small, modular nuclear reactors (SMNRs). With the range of options available, what is a mining company to choose?

“Solar is the universal options – possible at almost every mine site around the world,” according to Hillig. “Wind is a bit more site specific and requires some wind speed measuring, typically over the course of a year. Geothermal and hydropower are very site specific. It makes sense to have a look at the levelized cost of energy (LCOE) for different options, e.g., simulation models can allow for a combination of different renewable energy sources and load optimization strategies to be considered.”

Kim Trapani, a mining project specialist at Stantec, explained that the decision over which energy source to deploy depends on “the availability and quality of the energy resource at the location; how much electricity the site is trying to offset with renewable energy; the system’s ability to deal with the potential intermittency of the energy supply; the available energy storage options; and permitting.”

As with all things, it is this latter point that can play an important limiting role in a mining company’s choice of energy source, as Trapani’s colleague Debra Johnson added: “while many older mines have hydroelectric plants, permitting can be more stringent today, potentially making hydroelectric development more difficult.” On the flip side, interest in SMNRs for remote mining is growing steadily “as people and communities come to realize the technology has been used safely for more than 60 years in nuclear-powered vessels, such as submarines and aircraft carriers.”

Meanwhile, in Stafford’s opinion, the “best option” to lower carbon footprint at mining operations may be energy storage. “Large-scale batteries help overcome the limitations of renewable generation: for example, for solar, there needs to be a large amount of available land, while wind turbines require the site to be in a high-wind area. Energy storage paired with a CNG/LNG solution avoids these geographic requirements, while still producing far fewer emissions than diesel generators.”

The challenges of renewables integration

The three biggest obstacles to integrating renewables are “cost, intermittency of power supply, and permitting,” said Stantec’s Johnson, picking up themes already mentioned in the discussion.

Johnson continued that overcoming cost objections is “complicated”: “In today’s economic environment, mines must utilize an internal cost of carbon, given that carbon taxes and commitments to net zero are real and looming. Drawing on incentives, as well as creating public-private partnerships, can also offer relief from capital costs.”

The issue of intermittency returns the conversation back to energy storage, which must be “reliable, cost-effective and large scale,” according to Johnson. “Some are turning to effective tools from the past, such as pumped hydro, sometimes with the new twist – especially relevant to mining – of utilizing closed underground mine sites. Progress is also being made in areas such as solar thermal systems. One example stores heat from the sun in salt; the heat is then used to run a turbine, several hours after the energy is captured. Configuring multiple sources of renewable energy with storage, creating a microgrid configuration, can also help make power consistently available.”

And then there is permitting. “Many renewable energy projects have been stuck in permitting for years,” noted Johnson. “Countries, including the U.S. and Canada, as well as regional jurisdictions, are working to reform energy infrastructure permitting systems to speed up renewable initiatives. While there is no silver bullet, working with a diverse team, able to address environmental, community, and risk concerns early in the process, can help.”

A final challenge, noted by Hillig, is the need to commit long-term to renewables. “Going down the renewable path means that energy costs – or at least a part of them – are fixed for several years. This can be a risk, for example, when the mining stops, but also a big opportunity, as we see today as energy prices explode.”

Supporting infrastructure

To what extent supporting infrastructure is required to support renewables integrations depends on “whether the mine is grid connected, as well as the amount of renewable energy being generated,” said Stantec’s Kim Trapani. For example, if the mine is connected to a grid with capacity to take any excess power generated, “there is limited requirement for energy storage;” however, on a remote site without grid connectivity, energy storage becomes a critical issue. “Batteries are a good option for storage on a smaller scale but, if the requirement for energy storage is significant, then pumped storage may be a much better solution,” the Stantec engineer concluded.

Picking up on Trapani’s second point, Hillig explained that “adding some renewables to a mine’s energy mix often does not require the addition of any significant components, such as energy storage or a sophisticated microgrid controller. However, for sophisticated systems that combine different energy sources and allow for running the site, at least temporarily, fully on renewables, additional investments are needed. Typically, a simple diesel power plant is then converted into a cutting-edge microgrid – including energy storage.”

Microgrids in mining

This brings the discussion to the use of microgrids in mining. A microgrid is a “network of power generation and distribution, separate from the large-scale utility grids we typically rely on for electricity,” said Aggreko’s Stafford. “Microgrids power a much smaller group of users – for example, a small town or an office park – and are typically powered by distributed energy, such as solar panels (either at utility-scale or smaller-scale rooftop installations), wind turbines, energy storage, electric vehicles and more. They may be connected to a grid but may also deliver power solely from their distributed assets.”

Microgrids are “particularly suited to mining,” said Carolin Käufler, business development manager for Sustainable Power Solutions for Rolls-Royce Power Systems. This is due to the fact that they can supply electricity (and, if required, heat) in remote areas, independently and far away from a power grid. They also supply electricity “very reliably, efficiently, and in an environmentally-friendly manner, due to the intelligent linking of different energy sources – renewable and conventional – as well as energy storage systems.”

“Advanced microgrid solutions are a proven and available technology that can support the mining industry’s need to become more sustainable,” agreed Donald Wingate, vice president, Strategic Customers and Solutions, Microgrids North America at Schneider Electric. “Mining operations historically have high energy needs. As they are generally remote, the cost of grid power is traditionally high and can have reliability issues. Advanced microgrids have the ability to control the costs of energy needs, but also assure high power quality and leverage sustainable sources of energy.”

According to Käufler, potential components of the microgrid include:

- Energy storage systems to complement renewable energy sources that cannot be ramped up and down at will. They provide grid stability, voltage, and frequency control, instantaneous power, plus the ability to de- couple peaks in generation from peaks in demand.

- Gas and diesel generators to provide power, reliably and quickly, on demand. Their load flexibility adapts output to the customer’s needs. They also provide emergency backup and help cope with load peaks.

- Combined heat and power (CHP) gas-fired plants may suitable for combined heat and power applications.

- Renewable energy sources offer zero carbon emissions, low operating costs, and low fuel expenses – but there are some drawbacks, as they can suffer output fluctuations (depending on factors, such as the weather

and time of day) and often require major capital investment. A smart microgrid uses storage and/or complementary generation technologies to optimize the use of renewables. - A microgrid controller to seamlessly integrate generation,

storage, and demand. This smart technology optimizes the production and use of energy to meet a user’s requirements, whether their priority is cost, carbon footprint, or availability.

Within the microgrid, “all components are connected to each other via a smart energy management system, which optimises the way in which the energy is used, both technically and commercially,” continued Käufler.

“Any excess renewable energy can be stored and then made available as needed. At the same time, fluctuations in power generation can be compensated for, providing voltage and frequency stabilization. The system is thus designed to provide a stable power supply at all times – even when demand for electric power is high and when systems are required to operate around the clock, securing uninterrupted operations and targeted revenues on all occasions.”

When it comes to establishing a microgrid at a mine site, each application poses unique challenges and requires a tailored system design, concluded Käufler. “Various factors influence the optimal choice of energy infrastructure at a mining site. Some of these are external, such as sun and wind conditions, and grid availability or stability; some are directly related to the mining company, e.g., environmental sustainability policies, available capital, or whether energy is considered a core competence. Other factors relate specifically to site, e.g., remaining life of mine, the load-profile, or the need for process heat. Given these multiple, interlinked concerns, it is essential to do a proper simulation of the mining site.”

“Is there ample space for solar panel installations? Is there enough sunlight available? Are fuel sources reliable? What are the capital costs for a project? Are there EPC firms available for building and commissioning? How can the system be maintained? These are all good questions that must be asked when designing a mining microgrid,” said Wingate. “Given these complexities, it is important to have a skilled design partner in place to mitigate risk, provide proven technology and have creative options as an energy partner.”

These creative options now include new business models, including ‘energy as a service’ offerings, continued Wingate. “Capital providers and technology companies are combining to provide off-balance-sheet solutions, with no-capital-upfront options, on a design-build-own-operate model, with the mine operation simply agreeing to buy the energy produced by the microgrid for the term of the contract.”

There are also partnership models that will “help mining companies execute and achieve their ESG goals, while providing cost-effective energy that is both sustainable and resilient,” added the Schneider Electric expert.

Time to go renewable?

So, is it time for mining to go renewable (or at least alternative). For Stantec’s Debra Johnson, the answer is clear. “Given the large energy requirements for mining, as well as the lagging adoption of renewables and other energy reduction measures in the past, miners are having to speed up adoption in the face of new expectations to decarbonize. Renewable energy adoption is one of the obvious foundations for decarbonizing, especially as changes in operations are often deployed at a much slower pace.”