The mining industry has long relied on diesel. Cleaner alternatives are however needed if the industry is to successfully decarbonize its mine sites.

By Jonathan Rowland

The phrase “net zero mining” is fast taking its place in the dictionary of 21st century mining buzzwords, just after the “digital mine” and slotting in ahead of the related term, “sustainable mining.” But as with most buzzwords, it’s often used with only vague concern over what it actually means. To begin an article about any aspect of net zero as it relates to mining, it’s therefore important to set some context.

Establishing what proportion of global greenhouse gas (GHG) emissions is generated by the mining industry is a good starting point – but it is harder said than done and is again subject to difficulties in definition.

For example, the mining process itself produces limited GHG emissions. About 0.01 tonnes of CO2 (tCO2) are emitted per tonne of iron ore extracted; a further 2.19 tCO2 per tonne of finished metal are, however, emitted when refining that ore into steel. The discrepancy between the mining of bauxite and production of finished aluminum is even greater.1

Although most estimates of GHG emissions from mining include primary processing, the weighting of GHG emissions so heavily toward refining and smelting operations is an important one to note. Improvement here will have much more impact in terms of emissions reduction than anything that happens in the pit itself. It’s also relevant to note that, although carbon emissions are generally the focus of global environmental action – and media coverage of it – in mining they are only (and perhaps not even the most important) aspect of environmental sustainability.

The use of water is at least as pressing, and often much more so within the local context.

A final word of introduction relates to the different types (or scopes) of GHG emissions:

- Scope 1 covers direct emissions, e.g., from the running of mining vehicles or the on-site (off-grid) generation of electricity;

- Scope 2 covers indirect emissions, e.g., from the generation of electricity purchased from external suppliers; and

- Scope 3 covers all those emissions produced along the supply chain – from the manufacture of mining and minerals processing equipment to the use of the finished products.

Net zero pledges – at least those with defined targets – most often focus on Scope 1 and Scope 2 emissions, since these are the easiest for companies to influence, although strategies to reduce Scope 3 emissions are now being developed.2

What about mining trucks?

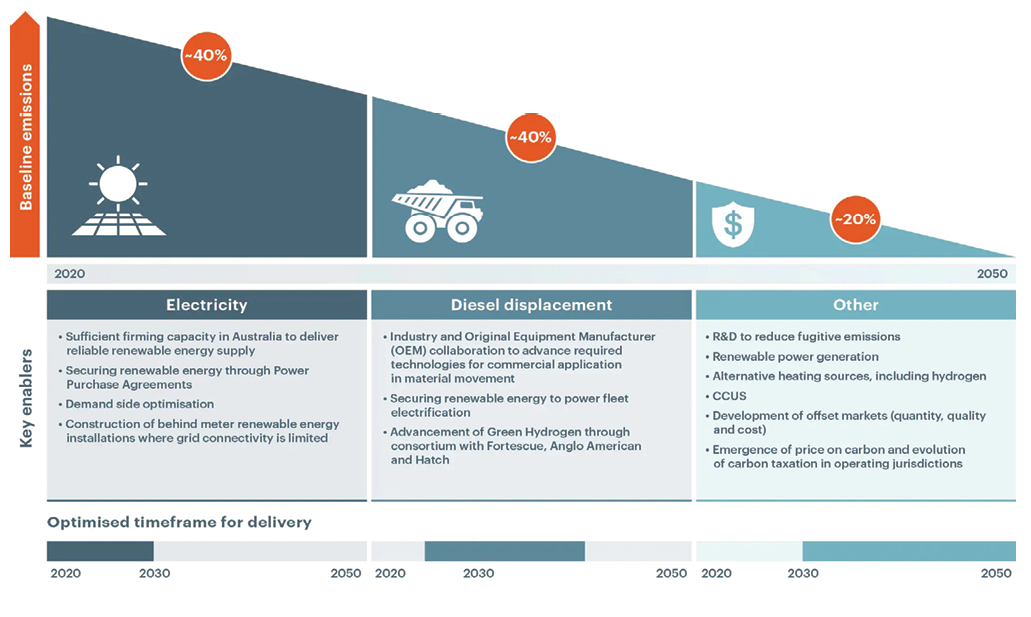

This preamble should help set emissions from mining trucks into the wider context. Even combining both Scope 1 (from the combustion of diesel) and Scope 2 (from the supply of that diesel) emissions, the roughly 52,000 active mining trucks3 nevertheless contribute only a very minor part of wider global GHG emissions. Yet abating those emissions must be a part of any mining company’s net-zero strategy, as Verónica Martínez, project lead of the Innovation for Cleaner Safer Vehicles program at the International Council on Mining and Metals (ICMM), explained to North American Mining.

According to Martínez, “when you start analyzing the emissions profile of mining operations, about 50% of direct (Scope 1) emissions come from the use of diesel in mining trucks. In specific regions, such as Chile, this number goes up to 80%.” When it comes to specific mining companies and their journeys to net zero, mining trucks are therefore a “very relevant source of emissions.”

A key initial step along this road relates to fuel efficiency. Fuel consumption depends on a range of factors – from truck load, speed, power and weight (empty and loaded) to acceleration, idle time, fuel quality, aerodynamics, road surface and grade, tire quality, alignment and inflation, weather and climate, truck condition and even the truck driver’s driving style.4 A 300-t truck may consume about 4,000 liters/day of diesel, but when that fuel is consumed through the day is therefore not consistent – as Martínez noted: “If you are coming out of the pit, fully loaded, that’s 70% of your fuel consumption.”

As a result, new technologies that can be retrofitted to existing fleets and that target the most fuel-intensive moments in truck operations can make a big initial difference, without the investment required to implement an entirely new fuel ecosystem.

At Boliden’s Aitik copper mine in Sweden, for example, existing mining trucks have been adapted to run with an electric trolley assist system out of the pit. The trolley line not only helps to reduce GHG emissions; it also improves the speed of the loaded trucks up-grade, thereby increasing mine productivity.

After a successful trial, the original 700-m route is being extended to cover some 3 kilometers of the mine site and is also being rolled out on a 1.8-km stretch of road at the Kevitsa nickel mine in Finland. The company expects to save 5.5 million liters of diesel a year when these systems are complete.5

Low-carbon fuels, such as B100 biodiesel, offer another option when it comes to decarbonizing existing fleets, although this option is contingent on the availability of optimized engine designs, the ability of mines to obtain B100 (without increasing their Scope 2 emissions), and the competitiveness of the cleaner fuel compared to traditional diesel.

“Mining companies will buy new mining trucks depending on their fleet replacement cycle, which is very site-specific. We therefore need to understand how to reduce the emissions of existing fleets. What are the technology pathways for this? Although they won’t get us to zero, they will allow us to significantly reduce emissions in a much quicker timeframe than relying on largescale capital investment in new vehicles,” said Martínez.

Transformational technologies: electrification

To reach net zero,xs mines will have to think outside existing technologies. There are numerous options here, notably hybrid and battery electric vehicles (EVs) and hydrogen-based systems. These will, however, require the adoption of new energy paradigms at both mine site – and more broadly. The electrification of mine trucks, for example, mirrors the electrification of the wider transport network in society in terms of its reliance on suitable battery technology (and the sustainable production thereof) and effective charging infrastructure.

Tackling that latter challenge, the Charge on Innovation Challenge, founded by BHP, Rio Tinto and Vale, and facilitated by AustMine, is asking technology supplies to develop scalable, interoperable solutions that are capable of delivering 400 kWh of electricity to a 200-t battery EV in a way that “maintains or improves current productivity levels, without adding time to haul cycle.”6

The number of challenge partners now numbers 21 mining companies, and 21 vendors have been shortlisted to progress past the initial phase. These include both established players, such as ABB, Hitachi and Siemens, as well as new entrants like BluVein, a joint venture between Swedish clean tech pioneer, EVIAS, and Australia-based Olitek that is already catching the attention of some big names in the mining industry.

Major truck manufacturers are also actively taking up the challenge. Caterpillar has announced a number of strategic alliances to develop zero-emissions mines. These include heavyweights BHP, Rio Tinto, Teck and Newmont alongside smaller players like Nouveau Monde Graphite, which is aiming to power its Matawinie graphite mine with zero-emission machines by 2028.

BHP and Rio Tinto are also among the founding partners of Komatsu’s GHG Alliance, alongside Codelco and Boliden. Announced in August 2021, the alliance will initially work to advance the company’s power agnostic truck concept for a haulage vehicle that can run on a variety of power sources, including diesel electric, electric, trolley, battery and hydrogen fuel cells.

Meanwhile, Liebherr committed to offering low-carbon emission solutions, including electric drives for all trucks and excavators, trolley assist and cable reeler systems be the beginning of this year.

It also signed an agreement with ABB at MINExpo International 2021 to explore the development of mine electrification technologies, with a focus on trolley assist systems, supporting the ultimate aim is fossil-fuel free mining equipment by 2030 at the latest.

Charging may be the most visible challenge when it comes to operative electric vehicles at the mine site, but it is not the only hurdle to electrification. As with every initiative of this type, mining EVs are only as clean as the electricity that energizes them.

“When talking about zero-emission vehicles (ZEVs), we aren’t just talking about emissions at the tailpipe,” said Martínez. “It has to take into account a broader view. Clean – renewable – electricity is therefore a key enabling technology of the mining industry’s decarbonization strategies; it must come first. There are regions that are progressing quickly in this regard. In Chile, for example, by 2025, about 90% of mines will have renewable capacity installed. Escondida, the largest copper mine in the world, is already operating with 100% renewable energy.”

Meanwhile at Nouveau Monde, the collaboration with Caterpillar is intended to “support the company’s goal to fully power the site with zero carbon footprint renewable energy,” Caterpillar said, with an “all-electric fleet complemented by the mine’s access to clean and attractively-priced hydroelectricity.” And this really goes to the heart of the matter, as Caterpillar continued: mining companies “cannot focus on one product alone to meet their objectives; they will need to consider their entire operations – from the power source, to the machine, supporting technology, infrastructure and the services.”

Transformational technologies: hydrogen

A number of mining companies and suppliers are also looking into hydrogen-based technologies, such as hydrogen fuel cell EVs, which offer similar performance and range to current diesel-power ultra-class trucks. For example, as part of its FutureSmart Mining program, Anglo American is working with multinational energy service company, Engie, to develop and fuel the world’s largest hydrogen-powered mining haul truck.

Engie is also working alongside research partners, CSIRO Chile and Mining3, to design and manufacture a new powertrain that allows mining vehicles to operate with hydrogen. The Hydra Project is one of three based around the use of hydrogen in mining supported by Chilean economic development agency, Corfo.7

Hydrogen also offers a “more integrated” approach to decarbonization for those mines not connected to the grid, according to Martínez.

“You can think of hydrogen as the carrier for energy across the mine, not just when it comes to powering mining trucks.”

This has been recognized by the Green Hydrogen Consortium, which includes BHP, Anglo American and Fortescue as founding members, alongside consultancy, Hatch, is working to explore the potential for hydrogen within the resources and mineral processing industries more generally.8

Skepticism remains, however, over how helpful hydrogen may be, even among consortium members. Dr. Huw McKay, vice president, Market Analysis and Economic at BHP, noted in an April 2021 podcast that “it seems unlikely that green hydrogen will achieve competitive narrow or all-in costs any time soon: certainly not in either the 2020s or the first half of the 2030s.

“[But] the future has a way of surprising you, and hydrogen may yet make a considerable contribution to our 2050 net zero objective for Scope 1 and 2 and assist with the material reduction of our value chain (Scope 3) emissions generated by the transport and use of our products. The route to that end state is not visible today, but we do not completely count it out.”

As with electrification, a key challenge is the sourcing of cost-competitive green hydrogen. Australian mining company Fortescue is one of those working towards a solution here, creating a spin-off company, Fortescue Future Industries, to develop a portfolio of both renewable energy and green hydrogen projects with the aim of supporting not only its own decarbonization strategy, but the decarbonization of other hard-to-abate sectors.9

The truck as a technology platform

What is emerging from the development work is that the nature of the truck is changing. From a single technology based around the internal combustion engine, in the future the truck is going to be a platform for a range of different technologies, which will differ from mine site to mine site, depending on local context.

“There is no silver bullet,” said Martínez. “Different technologies will be required. We should therefore be thinking of the truck as a platform into which we can plug a range of technologies, depending on the needs of the mine and the local context – for example, the availability of clean renewable energy or onsite green hydrogen.”

It’s a concept that has been picked up by the truck manufacturers, as exemplified by Komatsu’s fuel-agnostic truck. For its part, Caterpillar confirmed to North American Mining its approach, stating, “A variety of solutions will be needed for customers and their specific job sites.”

Oliver Weiss, executive vice president for R&D, Engineering and Manufacturing, at Liebherr Mining Equipment was perhaps most eloquent on the topic, however. In an article for Liebherr’s in-house magazine, flexibility, he argued, is the only way forward.

The “future portfolio of solutions will be less electric grid dependent, providing more flexibility and will likely be based on a combination of technologies,” he said.10 “Flexibility is provided through on-board energy storage with the use of batteries or renewable fuels, such as hydrogen or hydrogen based derivate fuels (ammonia, methanol or more sophisticated e-fuels).”

Weiss continued in an optimistic vein, noting that, “methanol combustion […] is ready to move towards serial engine industrialization based on market demand [while] hydrogen combustion engines are currently being tested in our factory in Switzerland. [We also see] high potential in the usage of ammonia for heavy mobile, high energy demanding machines.” In addition, when “more sophisticated e-fuels become competitively available at large scale, Liebherr is ready to utilize these fuels in machines equipped with Liebherr engines.”

This positive attitude is mirrored more broadly through the industry, said Martínez.

“We’re seeing an acceptance that this is possible with companies creating partnerships for trialing and testing. But this is the key challenge now: how do we get to the trialling and testing phase faster? Do we need to bring in investors or other actors to accelerate progress? Are there key jurisdictions that might be more suited to move into early adoption?”

These are questions that ICMM is grappling with as it works with companies to facilitate change in this space – but the progress made is already impressive. “The ambition of the Innovation for Cleaner Safer Vehicles program is to make zero-emission solutions available by 2040, and we are seeing partnerships between ICSV participants that are helping to accelerate the development and adoption of such solutions,” said Martínez.

One tool that has helped to support this progress is the ICMM’s Maturity Framework (icsv.miningwithprinciples.com/ghg-maturity-framework), which helps mining companies understand where they are today, compared with where they want to be. It has also created a common language around zero-emission trucks that is vital for collaboration.

“The framework has been used by member companies to self-assess over 100 mine sites globally,” explained Martínez. “Now these companies are in a position to develop their own roadmaps, identifying what partnerships are needed, what capacity they need to make available. For example, BHP has its fleet decarbonization snapshot, which starts with trolleys then moves to batteries and widespread adoption. We have moved from a place where decarbonization of mining trucks was wishful thinking to now thinking about practical implementation.”

A solvable challenge

As with all areas of the mining industry’s sustainability journey, there are challenges ahead. But zero-emission trucks – albeit representing only a small part of the grand picture of carbon emissions reductions – now appears to be a challenge that not only can be solved but will be. And relatively soon. This makes it a potentially important example for other, more intractable, challenges, as Martínez concluded.

“We’re positive that change can now happen. It’s a good example for other areas of the new-zero transition, showing how collaboration over a problem can lead to practical partnerships that accelerate change. It’s an important lesson to learn as we start to think about the bigger challenges, particularly those associated with Scope 3 emissions.”

References

1. Cox, B., Innis, S., Kunz, N.C., and Steen, J., ‘The mining industry as a net beneficiary of a global tax on carbon emissions’ Communications Earth Environment, 3.17, (2022): https://doi.org/10.1038/s43247-022-00346-4

2. Scope 3 emissions are the hardest to define and abate, requiring significant collaboration between mining companies, their suppliers and customer, but are where the vast majority of a company’s GHG footprint will lie. Minimizing Scope 3 emissions is therefore crucial to GHG-reduction goals, a fact that is being recognized by the industry, e.g., in the latest Climate Change Position Statement of the International Council on Mining and Metals: https://www.icmm.com/en-gb/about-us/member-requirements/position-statements/climate-change

3. Parker Bay: https://parkerbaymining.com/mining-equipment/mining-trucks. Includes trucks with a payload rating of 90 tonnes and above.

4. Kecojevic, V., and Komljenovic, D., ‘Haul truck fuel consumption and CO2 emissions under various engine load conditions, Mining Engineering, 62.12 (2010), pp. 44-48: https://www.researchgate.net/publication/261214668_Haul_truck_fuel_consumption_and_CO2_emission_under_various_engine_load_conditions

5. ICMM: https://www.icmm.com/en-gb/case-studies/2021/icsv/boliden-electric-trolley.

6. Charge on Innovation Challenge: Vendor Technical Information (May 2021): https://chargeoninnovation.com/wp-content/uploads/2021/05/Charge-On-Innovation-Challenge-Technical-Information-LR.pdf.

7. CSIRO Chile: https://www.csiro.cl/en/hydra-project/.

8. Climate Leaders Coalition: https://www.climateleaders.org.au/case-studies/bhp-1/.

9. Fortescue Metals Group: https://www.fmgl.com.au/workingresponsibly/climate-change-and-energy.

10. Weiss, O., ‘Zero emissions mining equipment’: https://www.liebherr.com/en/usa/magazine/zero-emission-mining/zero-emission-mining.html.