Edited by Josephine Patterson

A new study released by Canadian public policy think-tank Fraser Institute finds that 388 new mines must be built by 2030 to provide the necessary minerals to meet international government mandates for electric vehicles.

“The sheer scale of mining required to meet EV mandates raises serious questions about the timelines being imposed by governments,” said Kenneth Green, senior fellow at the Fraser Institute and author of “Can Metal Mining Match the Speed of the Planned Electric Vehicle Transition?”

In December 2022, Canada’s Action Plan for Clean On-Road Transportation established regulations that would lead to the phasing out of new fossil-fueled powered vehicles. The country aims to have 35% of all new medium- and heavy-duty vehicle sales be electric by 2030, rising to 100% of all new medium- and heavy-duty vehicle sales being electric by 2040.

Similarly, the United States has set a target requiring 50% of all new passenger cars and light trucks be electric, or largely electric hybrid, in 2030. The Biden administration also issued an executive order that requires the federal government to transition to 100% zero-emission vehicle acquisitions by 2035 for its own vehicle fleet.

Green called both countries timelines “ambitious” as they look to expand the prevalence of EVs in a very short amount of time – seven to 10 years. “The significant risk of inadequate mineral and metal production threatens the viability and realism of [these] government-mandated EV transition plans,” Green noted.

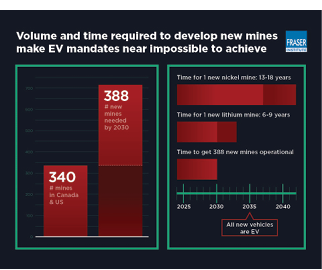

Due to the time required to locate, design, develop and build mining and refining projects – including time related to regulatory requirements imposed by the government – it can take between 13 and 18 years to start nickel production and six to nine years for lithium production. “In light of these production timelines, the Canadian federal EV mandate, which is approximately 11 years away, seems unrealistic,” said Green.

The International Energy Agency (IEA) suggests that to meet international EV adoption pledges, the world will need 50 new lithium mines by 2030, along with 60 nickel and 17 cobalt mines. The materials needed for cathode production will require 50 more new mines, and anode materials another 40. The battery cells will require 90 new mines, and EVs themselves another 81. In total, this adds up to 388 new mines.

For context, as of 2021, there were only 270 metal mines operating across the U.S., and only 70 in Canada. If Canada and the U.S. wish to have internal supply chains for these vital EV metals, they have a lot of mines to establish in a very short period.

“The establishment of aggressive and short-term EV adoption goals sets up a potential conflict with metal and mineral production, which is historically characterized by long lead-times and long production timelines. The risk that mineral and mining production will fall short of projected demand is significant, and could greatly affect the success of various governments’ plans for EV transition,” Green concluded.

The full report can be found at www.fraserinstitute.org/categories/energy.